is there a death tax in texas

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. Book a Consultation 512 410-0343.

Texas Inheritance Laws What You Should Know Smartasset

Only a very small percentage of estates will be subjected to an estate or inheritance tax.

. The Estate Tax is a tax on your right to transfer property at your death. 2 What Is Federal Estate Tax. A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million.

Texas does not have an estate tax either. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. There is a 40 percent federal tax however on estates over.

It is a transfer tax imposed on the wealthy at death. The federal estate tax is a tax on your right to transfer property at your. Although theres no estate tax in Texas you still might have to pay federal estate taxes.

While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. There is a Federal estate tax that applies to estates worth more than 117 million. There are two main types of death taxes in the united states.

Taxes levied at death based on the value of property left behind. Death Taxes in Texas. Pros of Death Taxes.

However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has. Taxes imposed by the federal andor state government on someones estate upon their death. The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal.

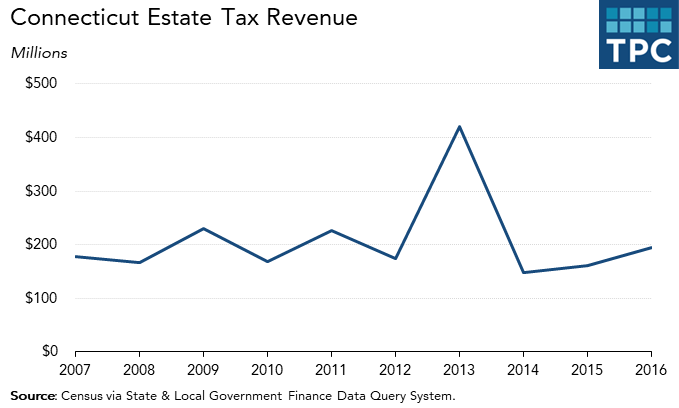

1 Inheritance Tax Texas. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from. Federal exemption for deaths on or after January 1 2023.

If you die with a gross estate under 114 million in 2019 no estate tax is due. Heres the good and bad. Call our estate planning attorneys to learn more.

The federal estate tax disappears in 2010. Pros and Cons of the Death Tax. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The state sales tax rate in Texas is 625 percent. Estate taxes and inheritance taxes.

Posted on September 7 2020 September 29 2021 by Staff Editor. Only 12 states plus the District of Columbia impose an estate. If your gross estate is over 114 million you pay a tax on.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. No not every state imposes a death tax. These taxes are levied on the beneficiary that receives the property in the deceaseds will.

Federal estate taxes do not. Death Tax In Texas.

Is There An Inheritance Tax In Texas

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Texas Aglaw Blog Towntalk Radio

State Estate And Inheritance Taxes In 2014 Tax Foundation

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

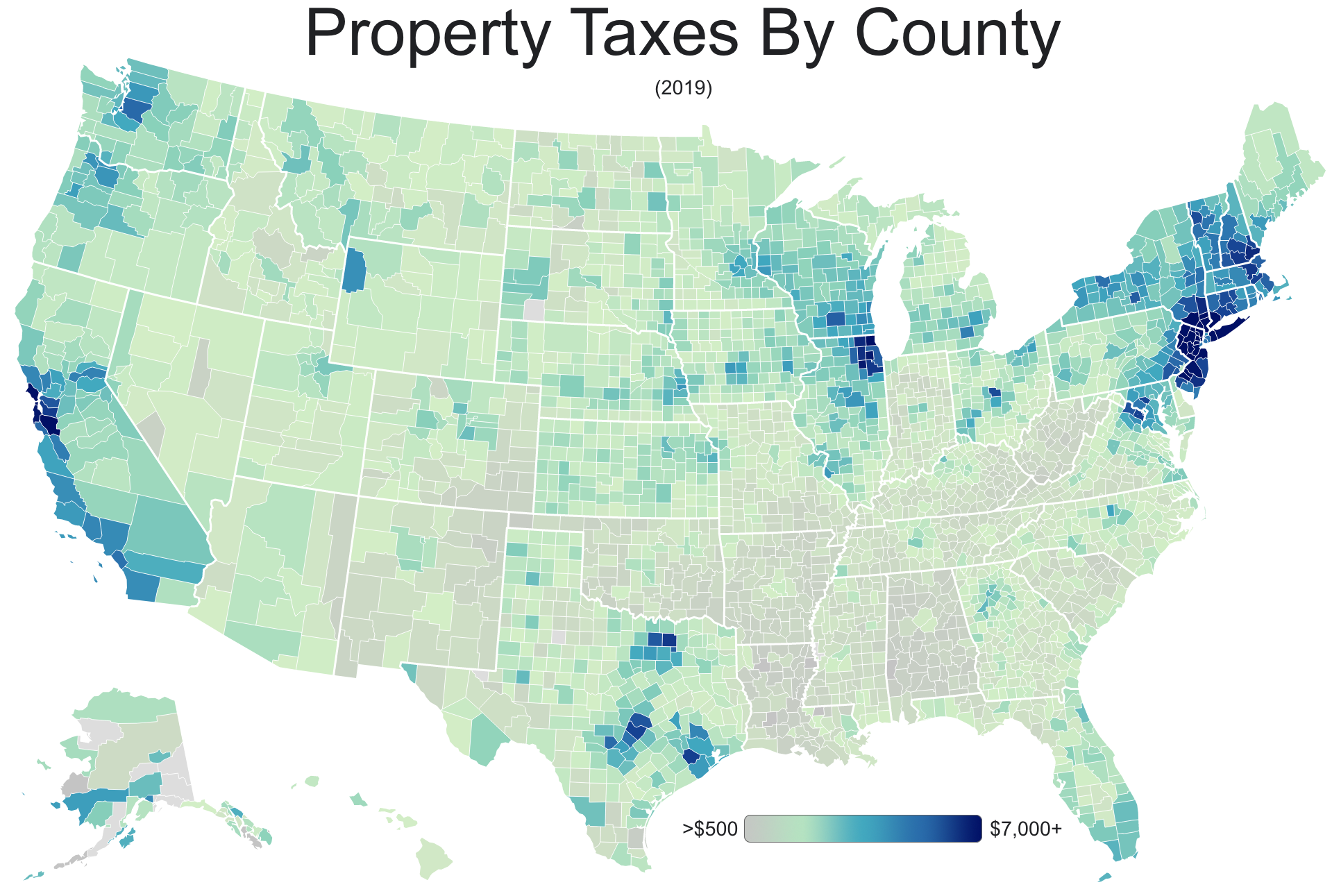

The Ultimate Guide To Texas Real Estate Taxes

A Complete Guide To Texas Payroll Taxes

9 States With No Income Tax Kiplinger

Property Tax In The United States Wikipedia

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Do All Wills Have To Go Through Probate In Texas The Law Offices Of Kyle Robbins

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Death Of Project Penguin In Marble Falls Sparks Some Calls For Tax Reform Austin Business Journal

The Death Tax Isn T So Scary For States Tax Policy Center

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

:max_bytes(150000):strip_icc()/GettyImages-1172587375-02bfb158e839497e8aed2be07e6ae70e.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)